(and an 8 figure exit)

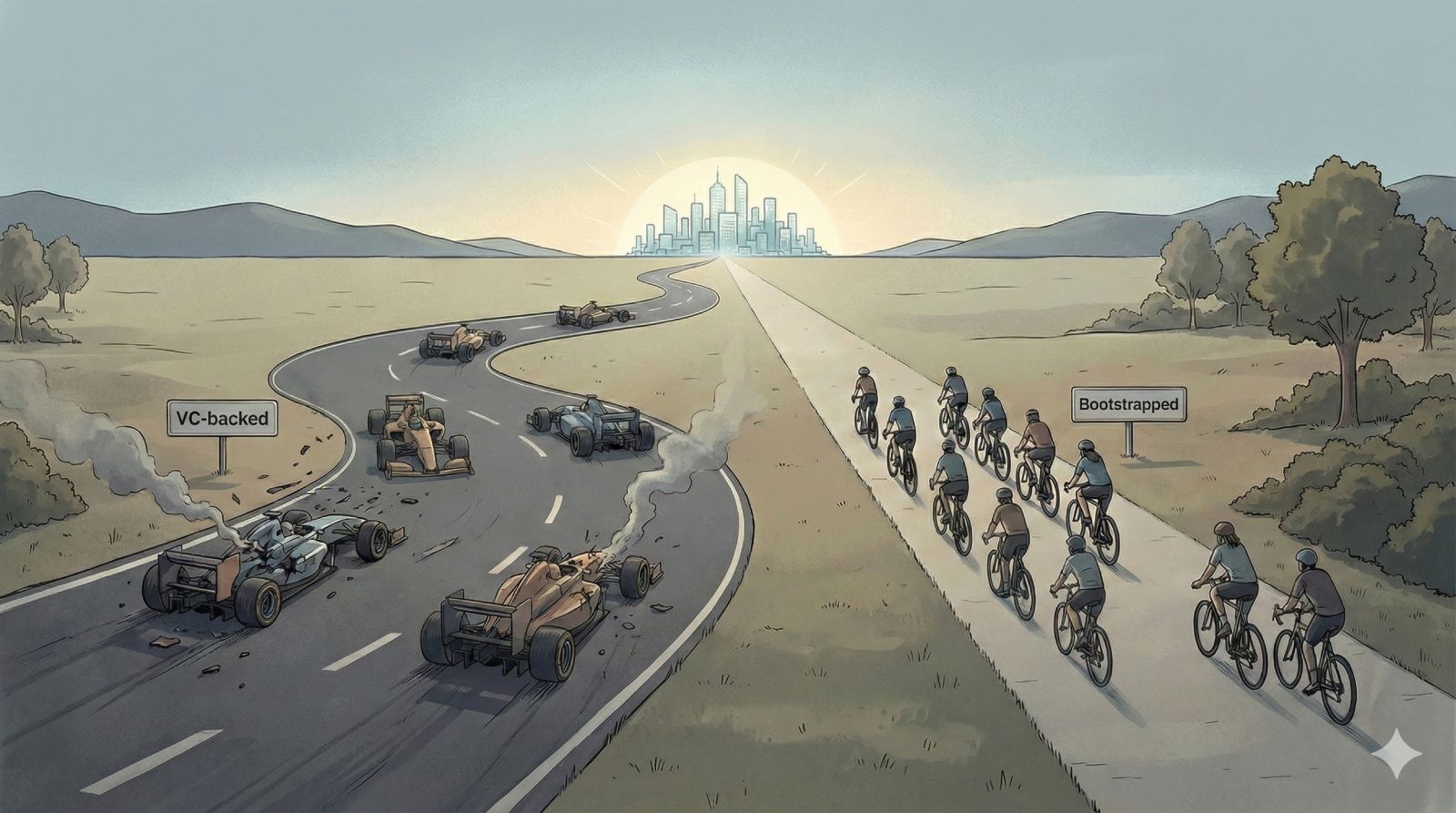

In 2016, after winding down a failed startup that went the VC route, I had $15k in my checking account. I had just moved out of the SV bay area to reduce my living costs.

My goal was to stretch this small amount of money as far as possible, while building a product that can sustain me indefinitely without taking outside capital (i.e, bootstrapping).

This was my first time starting a company solo. I had to learn how to acquire customers, how to do customer service and how to be more receptive to user feedback – things I never had to do at previous stops, where I was *just* the technical leader.

It took 4 years to get to $12k MRR, and then another 4 to mid 7 figures in ARR. I learned the value of consistency and persistence, and the power of the cheat code that is the B2B SaaS business model.

In this article I want to reflect on the important inflection points that helped moved the needle, and turn a middling side project into a life-changing outcome.

Early days – Learning by doing (and talking to customers)

The company I started is called Gymdesk – a business management software for gyms, martial arts schools and other fitness businesses. I had an intimate experience of the use-case as a customer – I’ve been training in Brazilian Jiu Jitsu since 2006.

I had a pretty good idea of the basic use-cases, however I had never actually run a gym myself. Though I conducted user interviews before spec’ing and building the product, and relied on my personal experience as a customer, in reality I had a *a lot* of learning to do to build a truly impactful product.

In vertical niches, general purposes solutions are insufficient – it’s the specific attention to niche use-cases that allows a product to be customized to that vertical, and be more useful than a general purpose product.

This process of learning happened organically, through a constantly evolving feedback cycle. I learned how to listen to customers, understand their goals – even when they don’t communicate it clearly or directly – and turn that feedback into a better product.

I would be the first to admit that at previous companies, I was not the best at understanding users who couldn’t figure out things that seemed obvious to me. The new mentality I had to adopt was that if a user was unable to do something, the fault was with me and the product, and it was an opportunity to make it better.

Getting to the point that I’m able to ask the right questions and infer the end goal, allowed me to improve the product in ways users didn’t anticipate, and often delighted them.

It took me years to develop the right approach and intuition for doing this process effectively and consistently. And by the end of 2019, the scope of the product was unrecognizable compared to where it was when it launched in 2016. An interface redesign was in order, to implement all the of the learnings of those 4 years into a more cohesive and modern package.

We launched the UI redesign at the beginning of 2020 (wrapped QA over Christmas), and it was then that we started approaching the elusive Product-Market-Fit. We went from 20% trial-to-paid conversion in 2019 to 30% in 2020, which included a small global event called COVID. By 2021, conversions reached 35%.

But what did I do to sustain myself in the 4 years leading up to this point?

Bootstrapping before significant revenue

The hardest time for any bootstrapped company, is keeping it going before it is profitable enough to live from. There are many alternative funding options available to bootstrappers – from non-dilutive capital, crowdfunding, to running a services company and more.

As for me, I went with the services direction for a while, working as a contract developer 3 days a week for an eCommerce company. Eventually, I was made an offer to join the company I was contracting for full-time, which I took after considerable deliberation as I felt it was too good to pass on. However, I added a special condition that I would only work 4 days a week (for a reduced salary), to leave me enough time to work on Gymdesk.

I kept working on it on the weekends from mid 2016 to mid 2019, when we reached $12k in MRR and I felt that I could quit the position in LA and be financially secure. Would I have made more progress if I could work on the product full-time between 2016-2019? probably.

However, I learned a lot through my fulltime job, and it was an experience that definitely added more skills to my toolbox – skills that I would later utilize to continue catapulting my company forward.

Figuring out marketing during a pandemic

2020 started off very strong – I started seeing growth I have never seen before. We went from $12k MRR to $15k in the first 3 months of 2020, and were on pace to double our revenue by the end of the year. Then COVID happened.

COVID hit our industry to a large degree, with most gyms shutting down, some for good. We had a stream of account freeze and cancellation requests, and we started losing MRR for the first time. Things stabilized somewhat by July, and we started seeing additional growth, but got wrecked again in the 2nd COVID wave in the winter.

Despite COVID, we still grew by 60% in 2020, which was much more than I expected. The additional revenue allowed me to start experimenting more with marketing, hiring writers to start outputting content more consistently, and working with a full-stack marketing agency for a while.

After several failed attempts with various agencies and acquisition channels, I slowly started to hone in on what actually worked. For us, it was content marketing / SEO, with organic traffic accounting for the bulk of our leads every month, and converting to paid accounts at the highest rates out of all our acquisition channels.

I hired our first full-time employee in mid 2021, promoting one of our contract writers to be our content marketing manager. Over the time, the consistent effort we put into content really paid off, and now dominate many high intent search results on Google which drive over 100 highly qualified leads per month.

Other things that worked for us include niche PPC networks on software comparison websites, a referral program, resellers and more. The more bandwidth I had, the more I could focus on experimenting and discovering new acquisition channels. We reached $45k in MRR by the end of 2021, and were adding $4k / month consistently at that point.

(I wrote in depth on all the marketing channels that worked for us, so take a look if you’re interested).

Joining the TinySeed accelerator

Near the end of 2021 I decided to apply to TinySeed, an accelerator focused on bootstrapped B2B SaaS companies. We were already close to $40k MRR at the time the program started, and I was asked often by other founders what made me join as it seemed to them we had most things figured out.

It was a dilemma I also struggled with before applying. The guiding principle for me was that if joining TinySeed increases the value of the company by at least 10% (the amount of equity they take), then it would be worth it.

In the end, it was definitely worth it, and while I didn’t learn much tactical knowledge during the program, it reinforced a lot of the things we were doing, giving me the confidence that we were doing the right things.

The mentoring from the partners, Rob Walling especially, was invaluable. And the relationships and interactions with other TinySeed founders were very helpful as well. Through TinySeed we also got introduced to our eventual broker, who guided us through out sale process.

During the accelerator, we updated our pricing, which changed our growth trajectory significantly. Rob Walling was instrumental in finalizing the strategy and messaging for this change (This is actually mentioned in his book, The SaaS Playbook, which I highly recommend).

Graduating from a sole operator to a real company

Up until I made my first FTE hire in 2021, I was the sole operator in the company. I had used contractors on occasion, but I was the only employee at the company, doing everything – from building the product, to handling support, running operations and doing marketing.

From 2021 to 2024, we grew from a single operator (myself), to a team of 16 at the time of writing this article. At first, I focused on hiring for very specific functions – customer service, various marketing roles, and eventually developers as well.

The main challenge I found myself facing was that being a very small team, I found my availability becoming a bottleneck. I underestimated the output of a founder/operator that ran the company solo for years, and has vast cross-functional knowledge, and expected new hires to be able to contribute on a similar level after a short ramp-up.

That did not work out, as might be expected, and I found myself investing the same amount of time I used to spend on the tasks that I hired for, on managing and directing the employees hired to replace me at those tasks.

I made plenty of hiring mistakes during that period. From hiring for the wrong role – I had a tendency to hire one or two levels of seniority less than what I actually needed – to hiring people who were not a good cultural and operational fit. Not everyone can be effective in a fully remote environment, where you need to be disciplined to keep executing without constant outside direction.

It took a period of recalibration of both expectations and role definitions, and of hiring people who can manage other people, until we got to the point from which my bandwidth was becoming available once again to drive the company forward.

Reaching 7 figures in ARR and exiting for 8 figures

My goal when starting Gymdesk, was to build it to where it could support me financially while I get to work on a product I love with customers I like. By 2021 I had achieved this goal, and a new goal had presented itself.

From mid-2021, I started receiving inbound interest from PE (private equity) firms to acquire the business. At first, I tended to ignore those, mainly since those are typically worded quite vaguely (“…are you looking for growth equity?”). Eventually, one of those emails was explicit enough that I was intrigued and took a call with the firm.

I had no interest in selling the company at the time, but I was feeling significant burnout, having run the company mostly as a sole-operator for 5+ years at that point. From 2021 to 2023, I took over 40 calls with various PE firms, and learned a lot about what a potential outcome might look like, and when it would make sense for me to potentially exit the business.

As time kept went by, and the burnout kept growing, I set a goal for myself to seriously explore a potential sale once we reach $3M in ARR. It was the revenue milestone at which most of the larger firms seem to start getting interested at (for an overview of the different types of PE firms, see this article).

I had built a simple P&L projection that showed us reaching that milestone around the end of 2023, and it ended being quite accurate. When we were getting close to hitting that goal, I felt that the time had come for me to move on from the business I spent 8 years building, and find a strategic partner that can take it to the next level.

I wrote in depth about the actual sale process, and ours ran between February and May 2024, ending in an outstanding outcome for all sides involved. We partnered with Five Elms, a large PE firm from Kansas City, MO, that is focused on B2B SaaS and has an extensive support structure in place to help its portfolio companies succeed.

Since the acquisition, I’ve been working closely with their team, to accelerate hiring, plans for growth and reinforcing the things we were already doing well. I did retain equity in the company, and I’m excited to see where it goes next.

What’s next for me

As of now, I’m still the CEO of Gymdesk, and as mentioned above I have significant equity in it as well. My intention is to step down as CEO, and focus mainly on product, and we have already started recruiting a professional CEO to take over.

This is also an exciting prospect for me, and I’m very keen on learning from someone who already took low 7-figure ARR SAAS to 8-figures and beyond, and see how they do it at Gymdesk.

Other than that, the new direction I’m venturing into, is investing in and mentoring early state B2B SaaS founders – helping them go from 0 to profitability and even a potential exit. I really liked the TinySeed model I went through, and I want to combine it with more of a personal 1-on-1 mentoring approach.

I already have several potential investment / mentoring engagements lined up, and each one is very exciting to me. After taking those early calls with the founders, I realized how much I enjoy discussing those topics relating to the operation and growth of B2B SaaS – the main thing I’m burnt out on is the actual day-to-day operational grind.

I’m looking forward to putting the experience I gained building Gymdesk up into good use, and helping other founders take the same path. If you are an early stage B2B SaaS founder, feel free to reach out!