There are almost too many paths founders can take nowadays to help build their startup – from completely bootstrapping (indie hacking), to raising venture capital to startups accelerators and incubators, and mentoring programs and anything in between.

In this article I’d like to make sense of how those different paths differ and the tradeoffs of each one, and then try to answer the question – is it a good idea to join a B2B SaaS accelerator?

What is a B2B SaaS Accelerator?

Startup accelerators provide a program for founders to learn and level up their skills in all aspects relating to building and growing a successful tech company. They also provide access to a network of founders who are going through the same process, as well as a small amount of venture funding (i.e, equity rather than debt) to further accelerate the company’s ability to execute on its current plans.

Startup accelerators became very popular at the beginning of the 2010s, with the success of high profile accelerator programs in the Bay Area, such as Ycombinator, 500 Startups (now 500 Global) and Tech Stars. (I went though the 500 Startups program back in 2013 with a company called Binpress.)

Now, a decade later, startup accelerators have become more specialized in order to differentiate their offerings.

B2B SaaS accelerators are a specialized type of a startup accelerator that focus on common strategies and approaches that work specifically for B2B SaaS companies.

How the B2B SaaS model is different

While a social media platform, or a ride-sharing app may need a lot of venture money in order to reach the scale in which it becomes relevant, B2B SaaS can become self-sufficient quite early, with minimal or no funding.

And as such, B2B SaaS accelerator lean on that model, offering a program that does not necessarily aim for a larger VC raise as most accelerators do.

One of the prolific SaaS accelerator programs is TinySeed, which I went through in 2021 with Gymdesk. It is a year long program that is aimed mostly at bootstrapped businesses that are looking to level up without getting on the VC / $Billion unicorn path.

The program offers bi-weekly calls with partners at the accelerator as well as mentors, covering a variety of topics such as customer acquisition, team building, pricing strategy and more. In addition, it provides access to a network of mentors and providers who work with B2B SaaS companies.

Is a B2B SaaS accelerator the right path for you?

Getting back to the main topic of the article – if you are the founder of an early-stage B2B SaaS company, which path should you try to follow? While there’s no one “right” answer, here are a few questions to ask yourself:

How much control of the company do you want to retain?

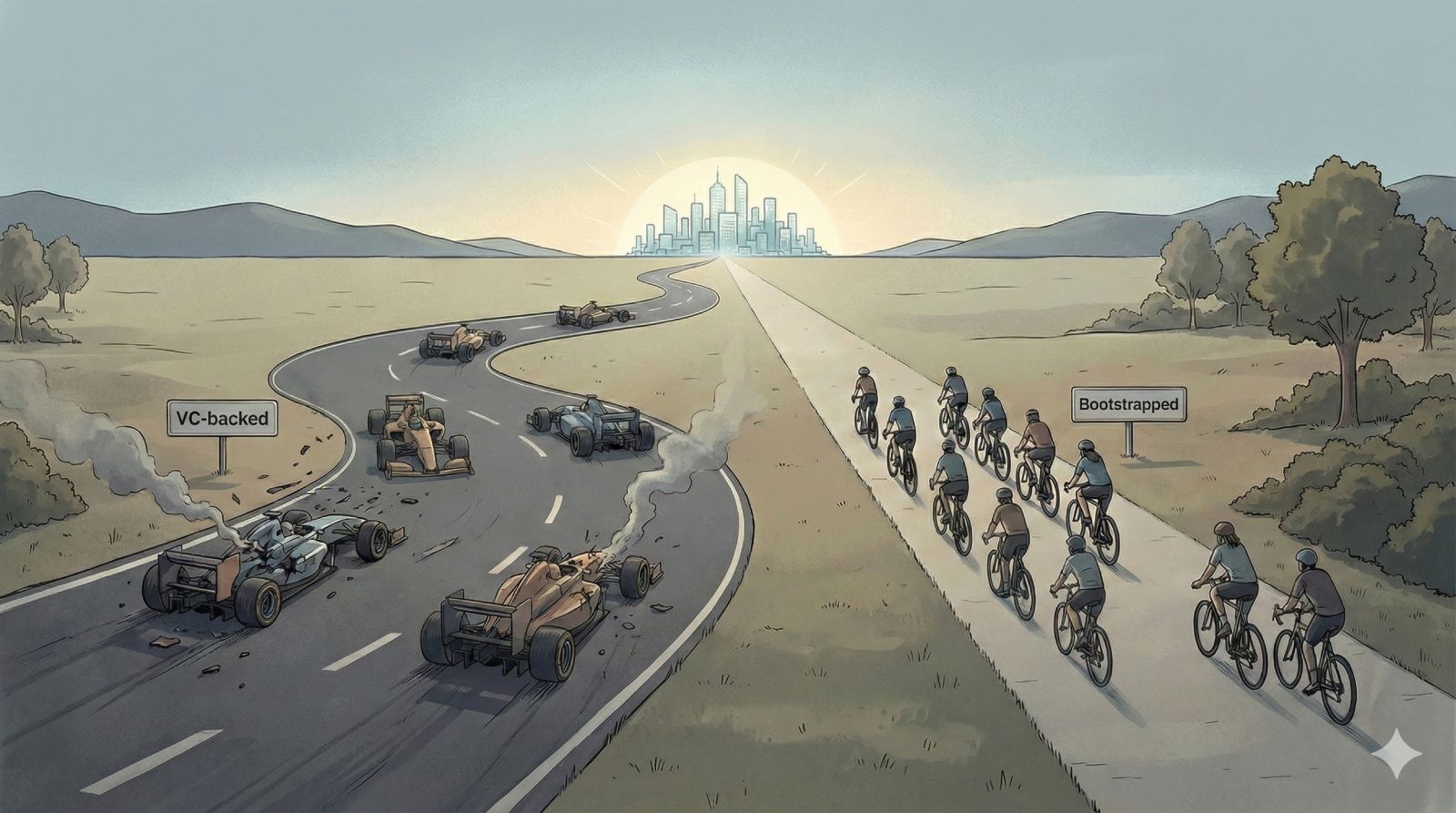

Taking equity based funding means losing some control of your company. How much equity you’re willing to let go can affect the direction in which you go. There’s an additional consideration there though – the expectations that come with each type of raise.

Raising from institutional investors typically requires you to demonstrate you have a potential billion dollar company, and will need to grow aggressively in order to reach that milestone in a reasonable timeframe.

Once you raise one VC round, you will typically need to raise additional, increasingly larger rounds every 18-24 months in order to sustain this growth (this is what I call “getting on the VC track”), giving up incrementally more and more equity and control.

Failure to raise an additional round will normally mean death for the company, as in order to fuel this aggressive growth, companies typically spend way beyond its ability to generate revenue (I called it the “death spiral” in a previous article).

After previous raising VC funding, I realized I’m not comfortable being on the VC track. With my most recent company, I bootstrapped for 5 years before joining TinySeed, and then continued all the way to an 8-figure exit without raising additional funding.

I found that this level of control much better suited how I wanted to build companies, but this might be completely different for you.

What resources would propel you to success?

Joining an accelerator or raising VC funding provides access to different resources –

- Raising VC funding – additional funds for growing the company

- Joining an accelerator – access to operational knowledge and mentoring, a smaller amount of funding

Some VC investors claim to be “smart investors” who can also provide mentoring and direction. In reality, very few institutional investors actually have relevant hands-on operational experience that can help early-stage companies succeed.

Meanwhile, accelerators often have a network of previously successful startup operators at many aspects (marketing, sales, product, etc), which can provide much more actionable and relevant advice.

Having said that, you should do some vetting yourself, as some accelerators provide access to mentors who have mostly been consultants or run agencies rather than have actually built a successful company.

On the other hand, VCs can provide much more funding than accelerators. So if funds are the most important resource for your company, a VC investment will take you further.

Was an accelerator right for me?

I’ve written at length on this blog about my decision to bootstrap rather than raise VC funding with my current company, Gymdesk. It ended up working very well, and gave me the time I needed to find Product-Market-Fit with the product.

When I was considering joining the TinySeed accelerator in 2021, the main catalyst was the founder partner, Rob Walling, and the incredible advice he was giving out regularly on the MicroConf and Startups for the rest of us Youtube channels.

We joined the accelerator at a later stage than most companies – we were already at $500k in ARR, and had a pretty solid understanding of all the main topics covered in the program. We didn’t actually make any use of the funding TinySeed provided, as we were already profitable and were spending conservatively as a bootstrapped business.

I was already planning for a potential exit, and the mental math I used to make that decision was whether joining TinySeed would increase the eventual outcome by more than the 10% equity TinySeed would receive. I decided that was a likely outcome and joined the accelerator mainly to get access to Rob as a mentor.

That ended up being a very good choice, as I relied on Rob’s advice during several critical junctures in the companies life – such as when we re-did our pricing strategy, and when I was hiring for the CTO role. I was also introduced to Einar, one of the TinySeed partners, whom I would later engage through his broker firm, Discretion Capital, to help us run the sale process.

From operator to mentor

The two options I mentioned above – VC funding and startup accelerators – are both structured and scalable approaches that work pretty well for a variety of different companies.

For me personally, I got the most value going through 2 accelerators when working directly with the founding partners – Rob Walling at TinySeed, and Dave McClure at 500 Startups (with a different company).

In those 1-on-1 sessions with seasoned operators who ran a company all the way to a successful outcome (Rob exited Drip, Dave exited PayPal), I got very nuanced feedback that comes from having experience not only in a specific facet of running a tech company, but from having run all of it as the lead person.

Which is why, now that I have the resources, I would like support early-stage founders as a mentor, in the same way that Rob and Dave helped me – and do just that, every week, until they no longer need any help.

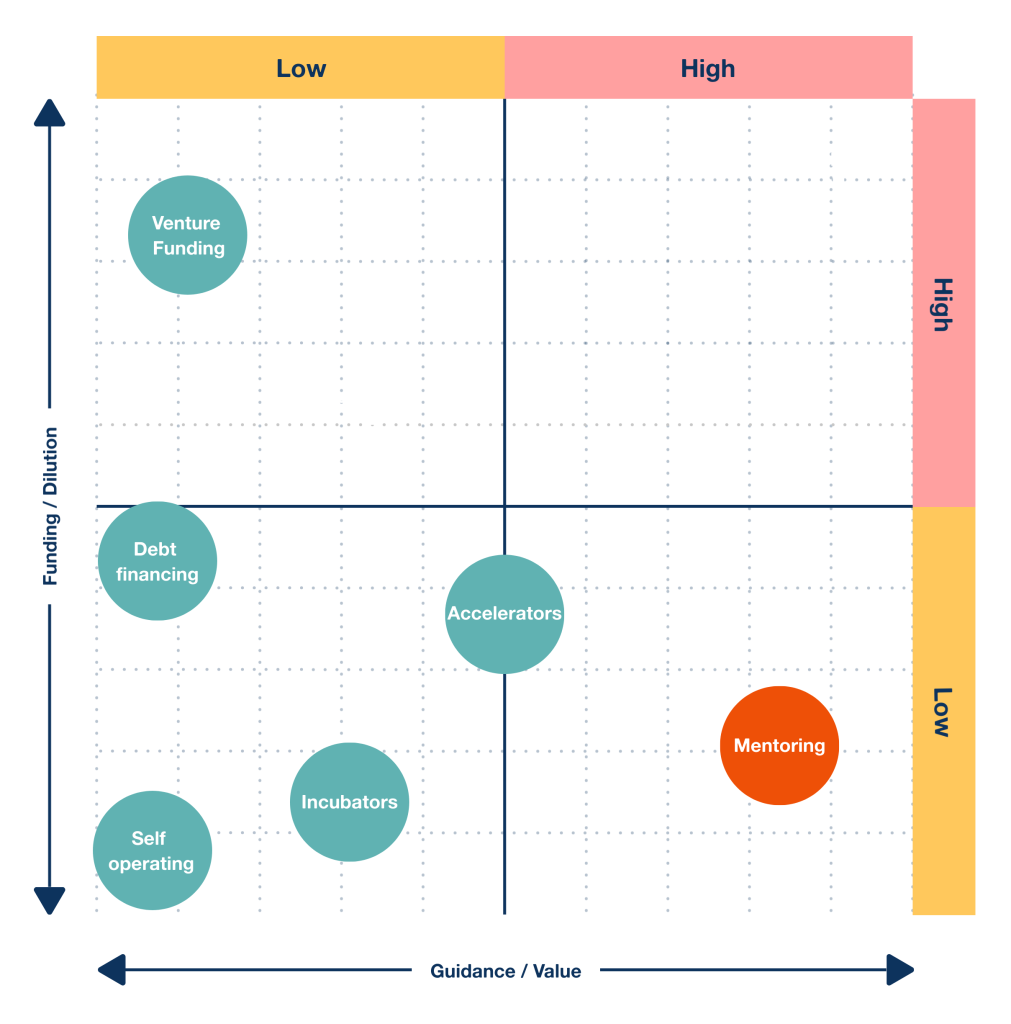

Raising vs. joining an accelerator vs. mentorship

Though it’s not very nuanced, I created a quick chart that shows how the 3 approaches I mentioned here compare on 2 axis – Funding (and corresponding dilution) vs. guidance and added value.

The tradeoff is more fiscal resources, vs. more intangible ones (mentoring, programming and guidance).

Which is the best for you? there’s no single right answer. This is a very individual decision influenced by your goals and how you want to get there.