When most founders think about launching a startup, raising venture capital is the first hurdle they believe is necessary for building a successful company, rather than a “lifestyle” business.

Media headlines, startup success stories, and influencer chatter often make it feel like fundraising is the key progress indicator of successful tech companies until those go public.

In practice, this narrative doesn’t match the reality for most founders. In fact, most companies will never become “venture scale”, meaning that raising capital from VC firms is not only a distraction, but potentially a pitfall that will prevent it from reaching its potential.

What Does It Mean to Be Venture Scale?

Venture scale refers to a startup that has the potential to grow so large, so fast, that it can achieve a valuation of $1 billion or more (a.k.a a “unicorn”).

In order to reach $1B in valuation in a reasonable time frame (~10-12 years), venture scale startups target very large markets and seek hyper-growth fueled by raising increasing larger funding rounds.

The venture capital investment model has evolved over several decades to optimize for investing in those so-called unicorn companies, and for VC firms to be successful they must continue to chase to yield returns that justify the high risks they take.

For B2B SaaS specifically, the trajectory of triple-triple-double-double-double (T2D3) YoY ARR growth, has become almost standard, as it allows reaching $100M in ARR in 5-6 years and a valuation of over $1 billion.

Defining Bootstrapping

Bootstrapping, in contrast, means building your startup primarily with your own resources and focusing on reaching profitability early to fuel growth. Instead of injecting large amounts of outside capital early on, the company relies on commercial revenue to grow sustainably.

Bootstrapped companies typically grow in a very lean way, relying on the founders to drive the business to initial product-market-fit (PMF) and early revenue, instead of pouring large amounts capital to grow head count and sales efforts at a rate that far outpaces revenue.

This approach usually leads to slower initial growth, but it also tends to create businesses that are more resilient, profitable, and positioned for long-term success.

Why Most Companies Are Not Venture Scale

Only a tiny fraction of startups ever come close to a billion-dollar valuation. The reality is that most founders build products for niche markets, tackle industry-specific challenges, or pursue growth strategies that don’t lend themselves to explosive hockey-stick curves.

Rather than building a narrative that their company is venture scale, many entrepreneurs will find greater success focusing on responsible growth, solid profitability, and delivering consistent value to a well-defined ICP (ideal customer profile).

Venture capital is simply not designed for these sorts of companies. In the venture world, patient growth, smaller target markets, and modest returns don’t move the needle. VC investors need a handful of exponential outcomes to justify their risk.

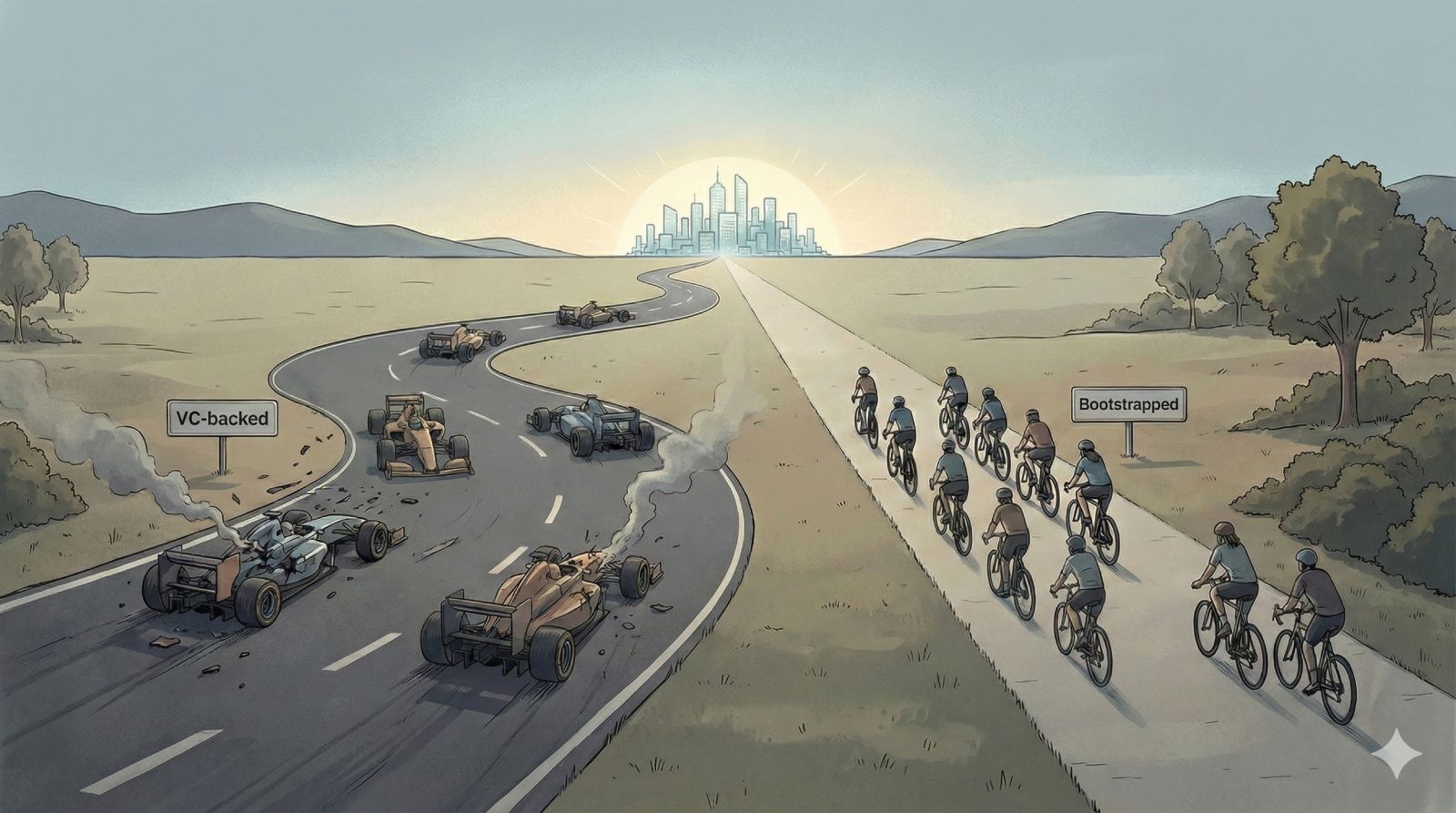

That means that if your company is not on track for exponential growth, or even the T2D3 curve for SaaS, it’s at risk of falling off the “VC track”, running out funding without the metrics to raise the next round, and ultimately shutting down due to spending way above revenue generation levels.

This is the main reason most VC funded companies fail, even if it could have otherwise been very successful businesses generating $10M-$50M in ARR, but not on the timescale that works for venture investments.

Common Misconceptions About VC Funding

One pervasive misconception is that taking VC money is the default or “best” path for building a success startup. The truth is more nuanced. Venture capital works best when your company:

- Targets an enormous, rapidly expanding market.

- Has a product with potential for explosive adoption.

- Operates in an environment where speed is your top priority (e.g., winner-takes-all dynamics).

- Has large initial capital requirements (such as deep tech or hardware businesses).

If none of these conditions apply to your startup, raising VC funding can potentially kill your company or severely limit your potential exit scenarios.

Once a VC investment is on the cap-table of a company, an exit that would have otherwise been life-changing for the founders if they had full control and equity, could be off the table entirely due to VC economics and deal structure.

The Advantages of Bootstrapping

When you bootstrap, you call the shots. There’s no board pushing for risky growth experiments that align with the timescale to reach a $1+ billion in valuation.

You choose how much to reinvest, when to expand your team, and which customers to focus on. Although bootstrapping requires more patience at first, it often results in a more sustainable, profitable business. You don’t have to sacrifice the future of your company by burning money for vanity metrics to secure your next funding round.

I’ve written about those tradeoffs previously in this article. Expanding on those points: choosing to bootstrap lets you continue to learn and iterate at the pace needed to reach PMF, which is different for each company.

With Gymdesk, it took me 4 years to reach PMF, far off the normal VC pace. I reached a life changing exit within 4 more years, an outcome that might not have been possible with a VC investment on the cap table, and definitely not with the funding timeline of venture capital (which typically provides a runway of 18-24 months).

Finding the Right Fit for Your Company

Instead of framing it as “Should I raise venture capital?”, you should ask yourself two questions:

- What kind of company am I building?

- Am I being honest about the size of the opportunity?

If your goal is to capture a massive market, become a category-defining juggernaut, and eventually a unicorn company, raising venture capital is probably the best track to achieve that result.

If you prefer to maintain control over your company’s culture and direction, grow responsibly while building a sustainable business, bootstrapping is often the better route. This might be your only real option if the size of the opportunity is not truly “venture scale”.

Ultimately, the funding path you choose should support your broader mission and the fundamentals of your business.

For many software founders, staying small and profitable, or at least growing at a sustainable pace – will lead to much better outcomes than joining a high-stakes race that most never finish.

Don’t let the media-friendly, VC narrative fool you: in a world obsessed with billion-dollar valuations, there’s much more room for companies that are healthy, impactful, and happily outside the venture funding track.